Responsible Bank

Committed to generate value to our stakeholders, so that through our products and services they can achieve their dreams, goals and purposes, and

build a better future for themselves and their families.

Environmental and Social Credit Asessment

Under the commitment to responsible banking, environmental and social assessment continues to be implemented through the Environmental and Social Risk Analysis System (SARAS) to the Business, Corporate, and high-risk sectors of the Entrepreneur Banking (SME) loan portfolio to mitigate the impacts on the communities where the projects are developed.

The due diligence of this system is based on the requirements of national legislation, and for higher risk cases, the International Financial Markets Standards apply.

-

In 2023, the SARAS system also incorporates socio-environmental due diligence to real estate received as collateral for the credit operations of clients subject to evaluation, according to the requirements of the National Commission of Banks and Insurance (CNBS).

-

91.5% increment of the total number of cases analyzed at the regional level compared to 2022.

-

In 2023, all the members of the Boards of Directors were trained in each country, and more than 220 collaborators at the regional level from the areas involved in the SARAS process.

Entrepreneurship, Education,And Financial Inclusion

Ficohsa Group committed to the personal and economic growth of different sectors of society, promoting entrepreneurship as an engine of development and job creation, accompanied by education and financial inclusion.

This program was born for clients in Honduras and Guatemala in 2022, to provide support to professional women, housewives, entrepreneurs, and businesswomen, it translates into stronger economic development and sustainable growth in our communities, promoting gender equality and opportunities.

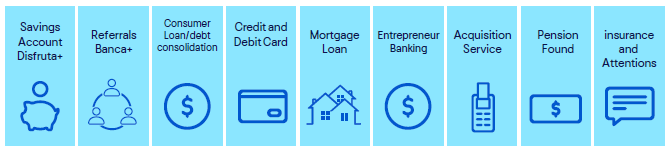

This year new benefits were added to the value proposition, highlighting the referral program for Banca+ clients and the Made for You assistance, thus strengthening the supply of financial products offered to Honduran women.

- The confidence of women in Honduras is reflected in the growth of:

- +15% in consumer deposit balances

- +53.8% in the growth of consumer loan balances / debt consolidation

- +19% growth in pension fund savings

- +19% in new customers in Entrepreneur Banking compared to 2022

In partnership with Supermercados la Colonia and the Foundation for Rural Business Development (FUNDER), Ficohsa continues to promote this program of support to the agricultural sector in Honduras, contributing to

the integral development of small and medium farmers.

To date +2,700 credits have been granted in 11 departaments of the country, benefiting +100 communities for the production of +40 products.

- +USD $7.8 Millions in agricultural financing to date,

- +USD $978,000 during 2023

- +USD 33.6 Millions in purchases to date by Supermercados la Colonia to producers of the program,

- +USD 4 Million only in 2023

- +14% participation of women in the program

- +85 producers trained in Financial Education

Other Entrepreneurial Initiatives

Since 2022, the “Young Impact Leaders for Central America” program has been supported through banking, and given the impacts and results achieved, it was decided to participate in the entrepreneurship component to continue promoting the growth, innovation and development of small and medium-sized enterprises in the country.

This resulted in a strategic alliance with the Chamber of Commerce and Industry of Tegucigalpa (CCIT), the International Organization for Migration (IOM) and Glasswing International to promote youth entrepreneurship in Tegucigalpa and contribute to the economic development of the communities.

Fifty young people will participate in the pilot of this program, who will be trained under the methodology implemented for the Initiate and Improve Your Business (IMESUN) training process, which is certified by the International Labor Organization (ILO). Ficohsa’s commitment with this initiative is to provide financial education to entrepreneurs and seed capital for the entrepreneurship kits. In addition, the participating women will become part of the Ficohsa Women Forward Program and other programs promoted by the Group.Dando como resultado la alianza estratégica con la Cámara de Comercio e Industria de Tegucigalpa (CCIT), la Organización Internacional para las Migraciones (OIM) y Glasswing International para impulsar el emprendimiento de jóvenes en Tegucigalpa y contribuir al desarrollo económico de las comunidades.

Projects and initiatives2023

Launching of the podcast Tu Bienestar Financieroon success stories and experiences.

-

1,699,272 users reached

-

71% are women

-

900 hours listened on Youtube

Financial Education Week organized by the CNBS

-

400 people trained, including young people, adults, women and the general population.

Global Money Week 2023

-

265 adults through face-to-face lecture/conference

-

42 children participating in the Savings Club

-

Reach of 509, 425 in social networks

Cybersecurity Month organized by AHIBA

-

+420,944 e-mails sent to customers and collaborators

-

+7,500 messages sent to clients via WhatsApp

-

SARA with educational capsule on how to avoid being a victim of financial fraud, "Take Care of Your Money."

-

Cybersecurity talk with 90 in-person collaborators and 170 virtual connected collaborators.

Financial Inclusion

Financial education and inclusion is seen as an opportunity to promote the sustainable economic growth of countries, as well as a key element for reducing poverty and immigration.

A Fintech dedicated to transforming access to financial services in Honduras, has more than 100 types of payments that can be made from the TENGO App and more than 5,000 service points, this allows new markets and areas to reach and penetrate to be able bank more people through innovative financial services that adapt to the needs of its clients.

2023 was a year of evolution in the company’s value proposition, going from being a local closed-loop solution to a payment solution with international standards; The above occurred due to the launch of the TENGO Visa rechargeable card; with the support of Banco Ficohsa Honduras. Nearly 8 million transactions were processed in total, growing +33% in coverage mainly in foreign areas.

The TENGO Visa Rechargeable Card is the most innovative and secure card on the market, since it has physical and virtual modes, is infoless and can be managed through the App.

In the first 4 months of operation, +45,000 cards were placed, mostly to people in an unbanked segment such as: Housewives, high school graduates, secretaries, workers, students and others.

7 out of 10 registered users in TENGO are unbanked people, that is, their first product or card, 71% of them are non-professionals.

Other Financial Inclusion Initiatives

Ficohsa Group official member of Partnership for Central America (PCA)

In 2023 Grupo Ficohsa became an official member of the Partnership for Central America (PCA)/Alianza para Centroamérica, joining a select group of companies and key players that seek to generate a positive impact in the region.

Advances

The SME loan portfolio in Honduras has increased by USD $60 million, USD $70 million in deposits, and has supported 8,500 new businesses. Over the next five years, the SME loan portfolio will be doubled, prioritizing the growth of women-led businesses with preferential loans, insurance and financial education.

We have achieved the financial inclusion of 60,000 people through TENGO, representing 8 million digital transactions. This is part of our commitment to include 200,000 vulnerable people in the financial system in the next 5 years.

In partnership with Glasswing International | Central American Services Corps supporting the “Jóvenes Líderes de Impacto por Centroamérica” project, an NGO that

empowers youth and communities to address the root causes of poverty, violence and migration, we have banked more than 3,500 youth and will continue to move forward with the goal of reaching more than 7,000 Honduran youth.

Committed to increasing remittance banking penetration by at least 20% over the next five years. To date we have surpassed our goal by banking 39% of total remittances received, representing USD $507 million with 32,500 new clients.

Information Security

Ficohsa continues to strengthen existing security controls and implement new technologies to enhance its cybersecurity posture and strengthen the confidence of its customers in the products and services provided. Working under the best cybersecurity and cyber resilience practices defined in the management framework, known as NIST SP 800-53 (National Institute of Standards and Technology), complying with the controls established in the maturity levels of the CMMI (Capability Maturity Model Integration) scale, so that operations remain protected and operational.