Quality and customer experience

Always in constant transformation, evolving every day to improve the client experience, to offer the best attention and services through innovation and quality to achieve their loyalty and trust.

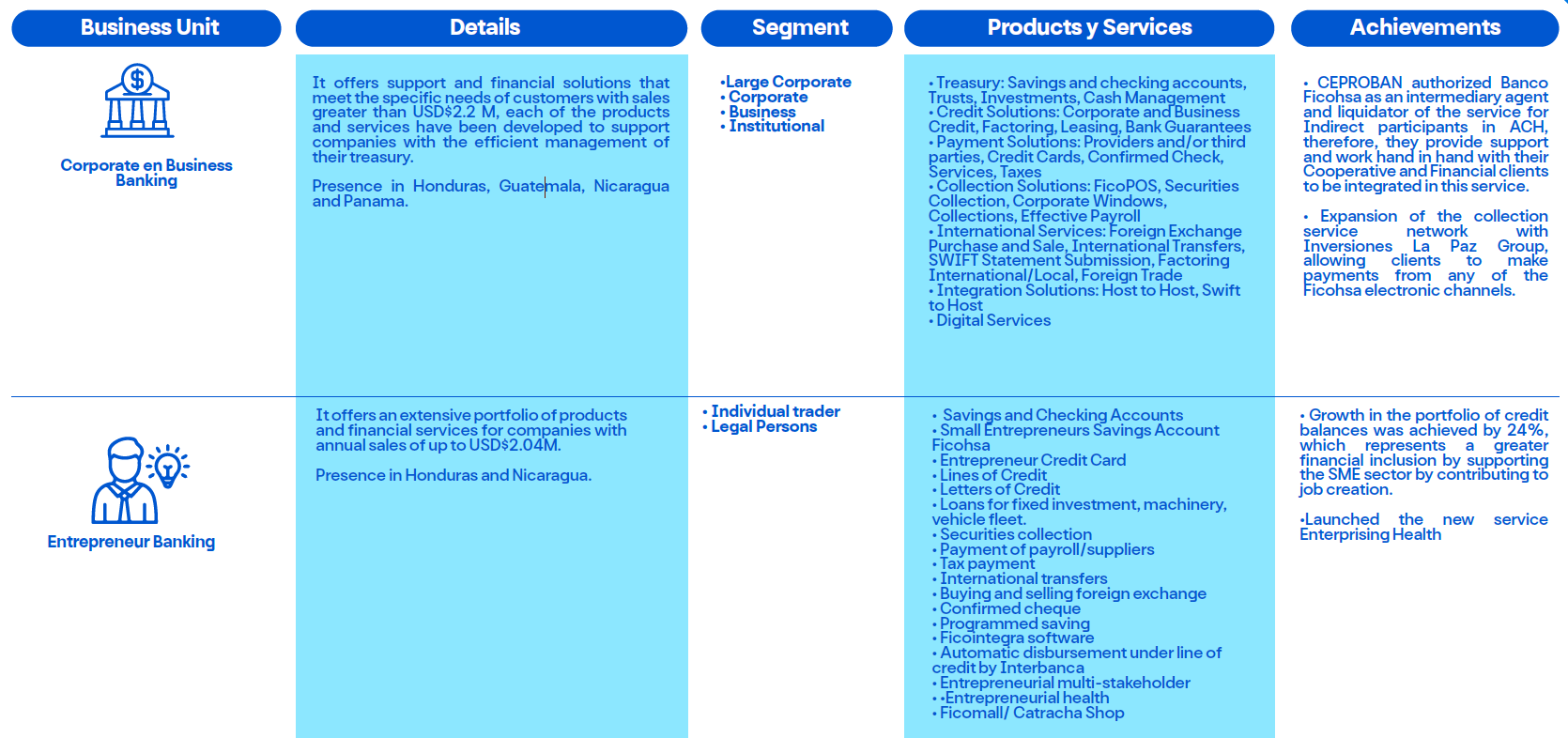

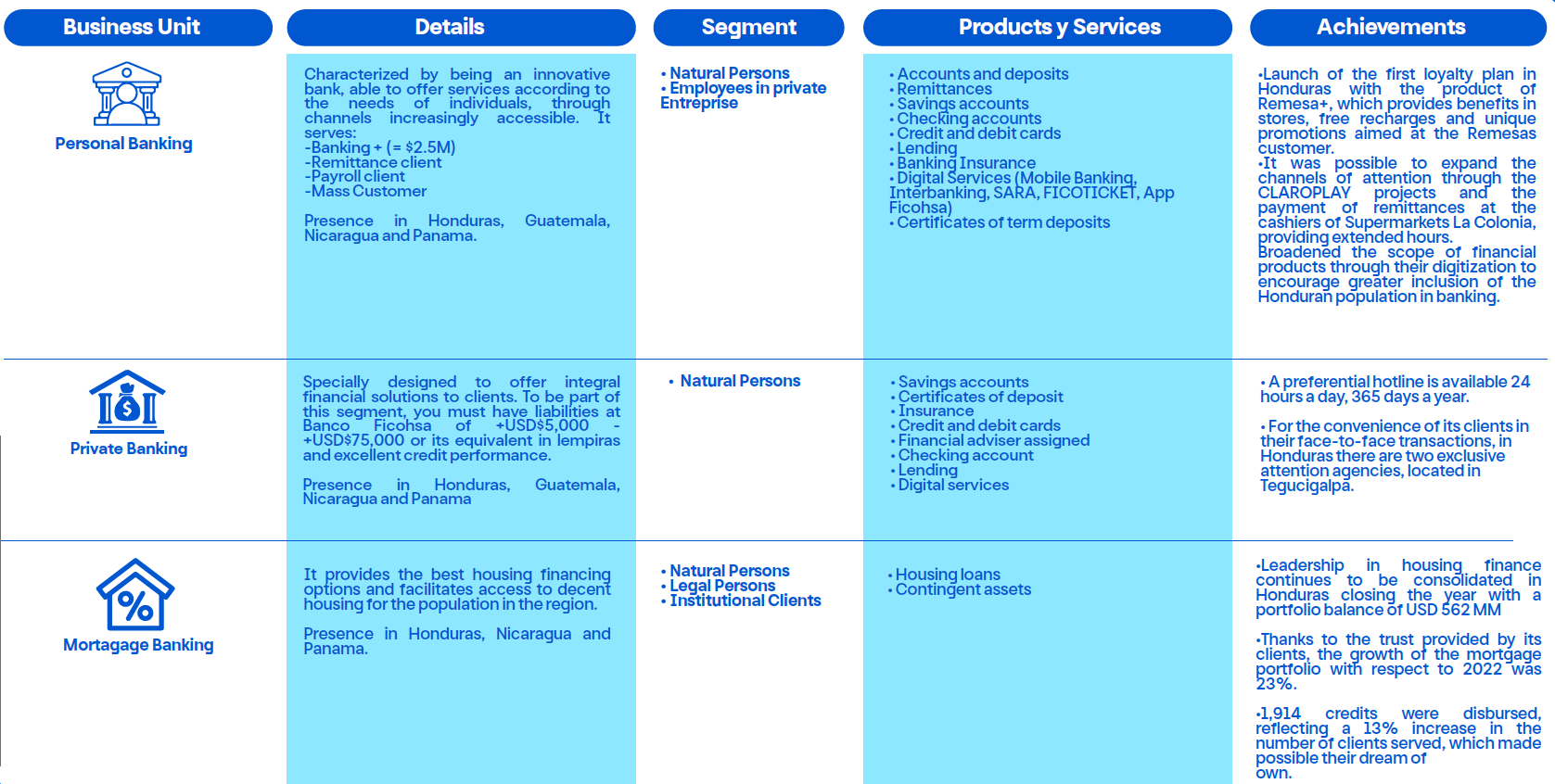

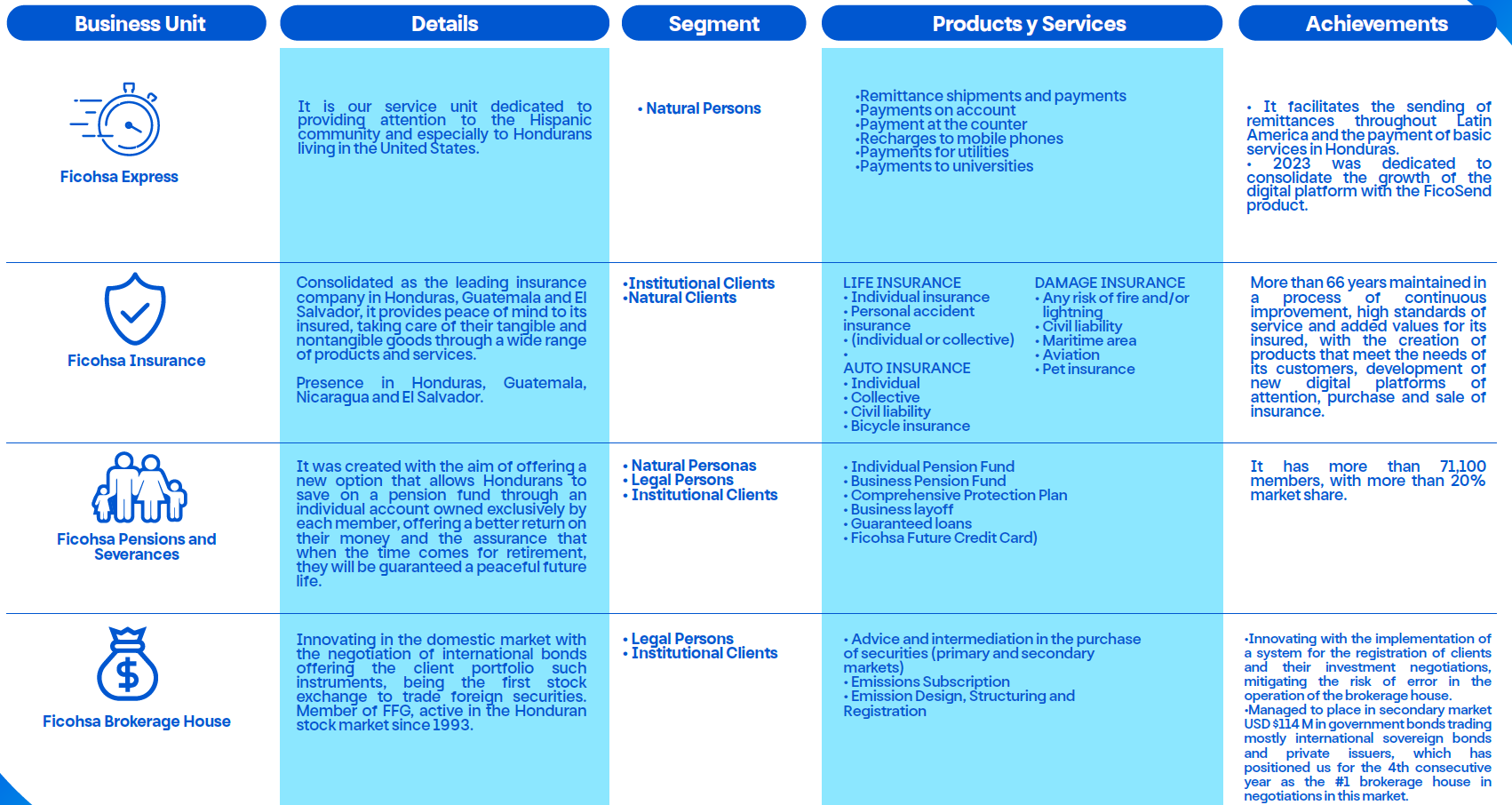

One of the main elements of the business model is client segmentation, which allows us to provide specialized care through each of the business units, dedicated to the development of products and services focused on the needs of each client.

Evolution and Digital Transformation

GF continues to innovate in the digital age, offering products and digital services designed to meet the needs of customers, facilitating access quickly, safely and conveniently. Connecting communities through innovation and technology

-

Attraction processes with an inclusive approach.

-

Generation of a memorable experience through participation in your first corporate volunteer activity.

-

Provision of tools that facilitate and standardize the induction plan in the area

-

Accompaniment to help them build their purpose through the IKIGAI technique, which seeks to achieve what one wants and desires in life.

All this is reflected in an annual growth of more than 25% in transactions made through the different Ficohsa digital channels.

Digital Factory

After an exhaustive evaluation for a digital transformation, in 2022 the Ficohsa digital factory was created, it was born to generate products, services, and channels 100% digital for all countries where we have a presence: Honduras, Guatemala, Nicaragua, Panama, and the United States.

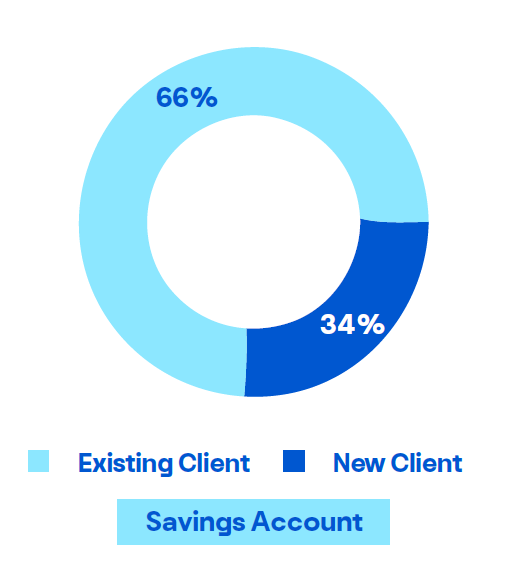

By 2023, Honduras already had the first 100% Digital Products, being these: savings accounts and personal loans, oriented to meet the needs and

expectations of clients. During the same year, the offer was expanded by

incorporating 100% digital credit cards and a new chatbot for the collection of

remittances. Additionally, the development of 100% digital Insurance was initiated.

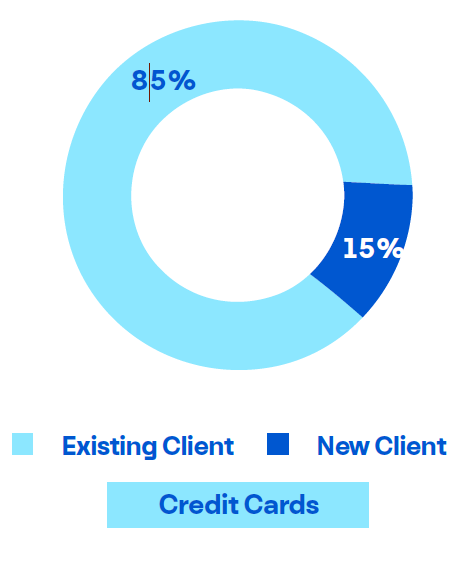

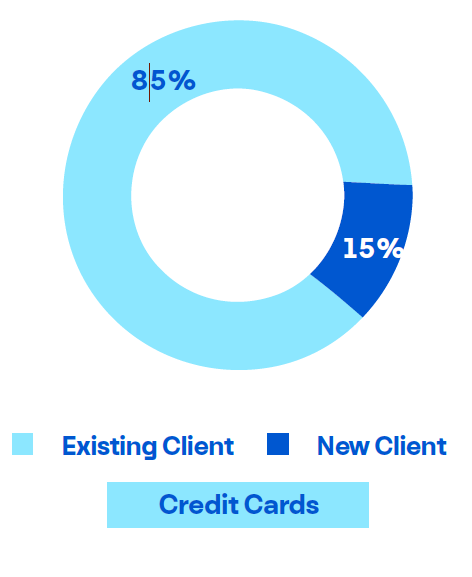

We can highlight this initiative with banking data with the participation of new customers acquiring financial products through digital alternatives.