6Responsible

Banking

6.1 Introduction

Our trajectory goes hand in hand with the value proposition for our customers. We are strongly committed to responsible banking, which materializes in the understanding of promoting change from the business and being able to be your trusted advisors. We understand that this role commits us to o er products and services that fit your needs while promoting sustainability in them under the inclusion of ESG criteria (environmental, social, and corporate governance).

Below we present the most outstanding initiatives we are carrying on:

- We continue with the application of the Environmental and Social Risk Analysis System (ESRA) for credit assessment.

- We deliver financing to promote renewable energy.

- Through partnerships we have a technical assistance program for sustainable agriculture of our clients with the aim of advising and supporting them to be more productive and sustainable.

- We started a program that addresses the needs of women in the countries where we operate, designing products and services focused on this niche.

- Contribution to the development of a financial and provident culture (insurance and pensions) in client through financial education initiatives.

- We generate savings and credit products that contribute to financial inclusion.

- We are training to identify green financial products.

6.2. Environmental and Social Credit Assessment

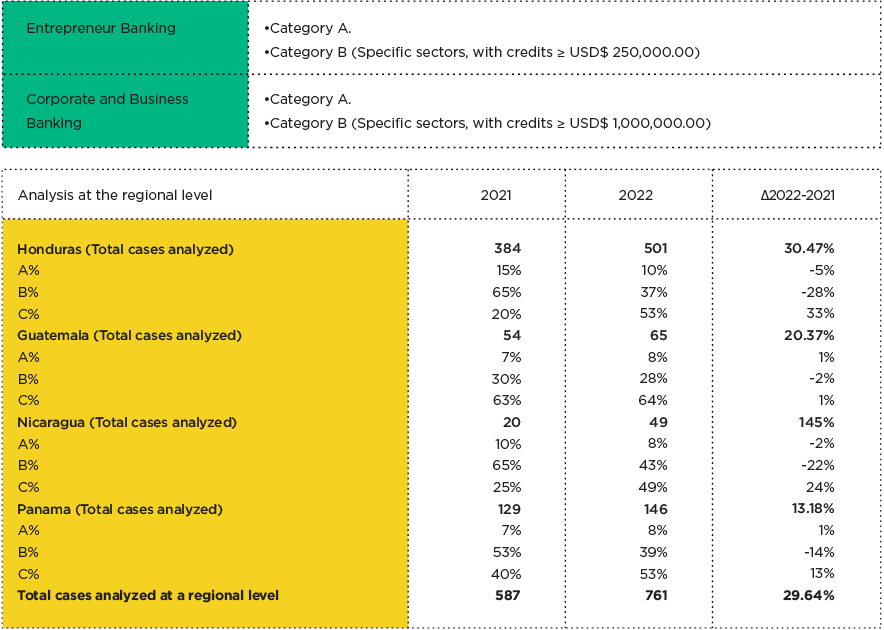

Aware of our environmental and social responsibilities towards the countries where we operate and recognizing that both our own operations and those of our clients have a potential for direct or indirect impact on the local, regional, and global environment, as well as in the areas of influence of the communities where they operate, in FFG we have established the Environmental and Social Risk Analysis System (ESRA) to monitor and mitigate these risks.

We are the first bank in the region to develop and apply this system since 2009 to the credit portfolio of the Business, Corporate and Entrepreneur High Risk Sector Banking (SME), which shows our intention to continue being a bank responsible for the environment and the communities.

The due diligence of this system is based on the requirements of each country’s national legislation, and for cases of increased risk, applying the International Finance Corporation (IFC) Performance Standards.

Environmental and Social Risk 6 Classification Categories

Projects with potential risks and/or significant environmental and social adverse impacts that are diverse, irreversible, or unprecedented. These applications are evaluated according to the requirements established by the national legislation of each country and international standards such as the IFC Performance Standards.

La categoría A está conformada por los siguientes rubros en cada país:

Honduras: Energy, agroindustry, Infrastructure, Mining and Fuels. Guatemala: Agroindustry and Energy.

Nicaragua: Agroindustry, Mining and Energy.

Panama: Energy and Agroindustry.

Projects with potential risks and/or limited adverse environmental and social impacts, which are few in number, generally located in specific sites, mostly reversible and easily accessible through mitigation measures. They are evaluated by the requirements of each country’s legislation.

Activities that generate minimal or non-adverse environmental and/or social risks and impacts. These are not subject to social and environmental due diligence.

During 2022 we incorporated new parameters for the implementation of ESRA:

We analyzed 29.64% more cases than the previous year.

During 2022, all the members of the Boards of Directors were trained in each country, and more than 200 employees at the regional level from areas involved in these processes.

Challenges for 2023:

- Apply all National Banking and Insurance Commission (CNBS) regulations for the ESRA system in Ficohsa Bank Honduras.

- Integrate, within the ESRA of Ficohsa Bank Honduras, the socio-environmental due diligence to real estate received as collateral for the credit operations of clients subject to evaluation, according to the requirements of the CNBS.

- Integrate a Climate Change perspective into the ESRA system at the regional level.

6.3. Green Financing

(FS8)

As part of our commitment to responsible banking, we play a key role in engaging and guiding investors and entities, o ering financial solutions that positively impact the environment and society.

15 projects of renewable energy (solar, eolic, hydroelectric, biomass) financed. During 2022 disbursements were: USD$10.2 MM Adding up to date the disbursement is of: USD$229.2 MM

6.4 Financial Inclusion and Support for Entrepreneurs

Through Entrepreneur Banking, we support the growth and development of small and medium-sized enterprises, thus contributing to the economic growth of the country and the generation of employment.

In 2022 Entrepreneur Banking achieved a credit portfolio growth of 27%

Increasing the portfolio of FFG credits to 32%, this represents greater financial inclusion, by supporting the country’s SME sector with financing, which contributes approximately 60% of the Gross Domestic Product and generates 7 out of 10 jobs.

Looking to boost this growth we launched the program Small Entrepreneurs and Small Entrepreneurs Savings Account: A program designed for children and young creative, innovative and leaders, ages 5 to 17, who are forming their experience in the world of entrepreneurship. The main objective is to strengthen the entrepreneurial spirit and the expression of their ideas as a tool to train independent young people.

6.4.1

At the beginning of 2022 we launched this program in Honduras and later this year in Guatemala. A value proposition aimed at the economic improvement and personal well-being of professional women, heads of household and entrepreneurs in the region. In Honduras women represent 51% of the population and it is important for us to contribute to gender equity, o ering financial services to this segment that was the most a ected during the COVID-19 pandemic.

In addition to o ering non-financial services, we made strategic alliances with Voces Vitales, Consortium Abogados, AMECOMEX Honduras, Tech4DevHn and Club Nacional of Woman Entrepreneurs to jointly promote other initiatives based on recognition, education, access to information and networking spaces designed specially to connect with the needs of women, always ensuring the fulfillment of the Ficohsa corporate purpose «to facilitate solutions that transform lives».

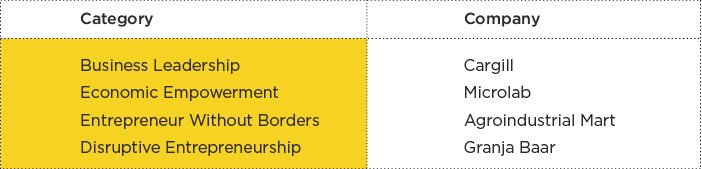

This year we also launched the first call for the Mujeres Adelante Award, an annual recognition that honors our female entrepreneurs/business executives’ clients who stand out for their excellence, manageability, innovation, influence, leadership, and career path.

Winners of the Mujeres Adelante Award

+60 nominations for the Women Forward Award.

+700 women trained in different areas.

+90 women entrepreneurs participated in fairs to showcase their products and services.

6.4.2

This program was born in 2013, with the aim of promoting initiatives that promote productive activities, entrepreneurship, innovation, and the growth of micro and small and medium enterprises (MSMEs).

We currently support more than 1,500 entrepreneurs/businessmen to reinforce the concept of buying what is Done at Home, to support them and boost their growth, we work to generate a sense of pride about the consumption of local products and awareness in the buying habits by preferring 100% products made by Honduran hands, since when we consume local, we grow all.

During 2022 we carried out various activities such as:

- The alliance with the Saturday Bazaar continued to o er spaces for sale and promotion of products and services.

- Alliance with TENGO to promote the Hecho en Casa movement.

- Social media campaigns to promote the program and the integration of more entrepreneurs.

For next year we are restructuring the program completely, during 2023 we will present the Hecho en Casa Foundation, sharing the same goal but with a broader vision.

6.4.3

FFG in partnership with La Colonia Supermarket and Foundation for Rural Business Development (FUNDER), provide access to financing for agricultural producers in rural areas of Honduras; we also support with technical training to make their agricultural processes e cient and have better harvests to achieve a secure market.

To date we have granted +2,600 credits in 11 departments of the country, benefiting from this

+100 communities

+USD$6.9 Millon in agricultural financing

+40 products harvested with this financing

Outstanding Achievements during 2022

- Signing of an agreement with farmers’ associations: De Mi Tierra promotes partnership, formalizing cooperation with 5 farmers’ associations and the Agro-commercial Consortium of Honduras, which groups them.

- Participation of the program in the «Launch of studies of the value chains of beans and vegetables in Honduras» carried out by the WFP: The study emphasizes the substring of Supermarkets La Colonia, which highlights the scheme and operation of the De Mi Tierra program, as a comprehensive scheme grouping essential factors for agricultural production.

- Support for farmers’ associations as a financial ally to develop business plans within the project «COMRURAL”.

Success Case

Eodora Méndez, tireless worker for the well-being of Honduran small farmers, is distinguished by the Inter-American Institute for Cooperation for Agriculture (IICA) as «Leader of the Rurality» Méndez, who belongs to the native people Lenca, grew up in a family of 13 brothers, who lived on the cultivation of basic grains and vegetables.

The Leaders of Rurality Award is a recognition for those who play an irreplaceable double role: be guarantors of food and nutritional security and at the same time guardians of the planet’s biodiversity through production in all circumstances.

From a very young age she trained in agricultural practices and issues such as access to financing and became the first woman president of the Agro-industrial Peasant Company of the Agrarian Reform of Intibucá (ECARAI), a beneficiary of this program, which brings together small producers from di erent communities in the Honduran department of Intibucá. Thanks to her, 325 small farmers have improved their income by the production and marketing of grains and vegetables.

Participates in the De Mi Tierra program since 2009

Beneficiary of +20 credits Equivalent to +USD$104 thousands

6.5 Educación Financiera

(FS16) (SASB FN-CB-240a.4)

At FFG, we encourage financial practices and habits that help not only our clients, but also our employees, suppliers, and the general public to better manage their money, achieve their goals, and build the future they want for themselves and their families. Our Financial Education program began in 2012, under this initiative we carry out educational campaigns in digital media, face-to-face events, and di erent communication strategies that allow the financial user to have a better performance in the management of their income.

+8.6 Million people reached at a regional level through educational campaigns in 2022.

Key part of our program is the portal

a site created to educate people about the proper management of their personal finances at every stage of life; they will find di erent easy-to-use downloadable items and tools which they can apply in di erent situations of their daily lives, in order to achieve adequate financial health, and as a consequence a better quality of life.

+39,0000 views of the portal Tuconcienciafinanciera.com During 2022

Throughout the month of October FFG celebrated the month of savings, where di erent activities were carried out at the regional level providing advice that will help people meet their goals and secure the future; they learn e ciently how to manage money, as well as the culture of saving for financial health.

Initiative to promote the inclusion and financial accessibility of young people in Honduras

Ficohsa Financial Group in partnership with Glasswing Honduras under its project «Young Impact Leaders for Central America», which is financed by the Howard G. Bu ett Foundation, joined forces to provide education and financial inclusion to more than 1,400 young Hondurans in the departments of Francisco Morazán and Cortés, contributing to breaking the gaps that these young people find when they want to insert themselves in the banking system, through financial education they can make better decisions regarding the administration and better management of their finances.

Glasswing International implements this project with the purpose of addressing the causes of forced and irregular migration of adolescents and youth between 15 and 22 years of age from Honduras. The program o ers alternatives, including stable income for community service in their own communities; development of socio-emotional skills, and preparation for work.

As part of the commitment to the social and economic development of our country, we awarded 25 scholarships to young people of the project so that they could receive the master class «Preparing for my next job» and thus acquire knowledge to help them enter the labor market and expand their opportunities.

Financial education is the basis for generating sustainable financial inclusion!