7 Client

Experience

and Quality

At FFG we strive to provide an experience focused on the needs of each of our customers, making available our wide range of products and services through innovation and quality to achieve their trust and loyalty.

Below we present the main actions, improvements, and achievements in our di erent lines of business.

Corporate Business Banking

We offer support and financial solutions that meet the specific needs of our clients with sales greater than USD$2.2 M; each of our products and services has been developed to support companies with the efficient management of their treasury.

- Updates were made on our platform such as customization of notifications, visualization of transactional history, and the option for authorizers of companies to specify the reason for rejection of a payment request, among others.

- From 2022, the use of the ONE SPAN platform is available, with it the electronic signature is formalized, it is no longer necessary to request physical documentation.

- 16 new ATMs were placed in di erent companies, so their employees can make their transactions and withdrawals quickly and securely.

- We signed an alliance with the National Directorate of Roads and Transportation (DNVT) to provide the best service experience when making payments of licenses, renewals, and fines through our payment channels, agencies, Interbanca, Ficohsa App and Tengo, managing to be the first bank to o er the option to pay for heavy licenses online.

Entrepreneur Banking

Aware of the importance of entrepreneurs for the region’s economy, in 2018 we developed a specialized bank to become partners in the development of this sector.

- During 2022, to improve the client experience, the option was made available to carry out their transactions in an agile and faster way through the portal.

- We partner with Latin American Trading, also known as Tienda Catracha store: An e-commerce platform specialized in exporting Honduran made products (nostalgic, non-perishable, artisanal, among others) to the United States and the rest of the world; it arises as an option for our customers to expose and sell their products.

- We made available to our clients the automatic disbursement under line of credit by Interbanca: it is a novel service that has the facility to make the application of a loan under line of credit, through Interbanca, which allows you to have the disbursement credit in minutes in the customer defined account. This is a unique service on the market at no additional cost.

Personal Banking

Our value offer includes making available all the opportunities of this new era, establishing a differential way of doing business, able to offer services according to the needs of individuals, through channels increasingly accessible.

- Launching of Caja Ficohsa: This year we launched the services and advertising campaign «Caja Ficohsa, a step away from you», which reflects the ease, and convenience of performing all your banking transactions 365 days a year, at any time, in more than 4,500 boxes nationwide. With extensive coverage in grocery stores, markets, 24/7 convenience stores, Supermarkets La Colonia, Kielsa pharmacies, and multiple businesses, being able to perform di erent transactions such as collection of remittances, payment of credit card, payment of loans and utilities, deposits to savings accounts, cash withdrawals, among others.

- Within our payroll automation system 26,500 accounts were handled under digital process, reducing the operational work especially in times taken for account openings.

Private Banking

Specifically designed to offer comprehensive financial solutions to our clients.

- During the last years, we have positioned ourselves as the best alternative for this segment of clients in the region, providing the best experience and the highest quality of service.

- We have a preferential hotline for our clients, available 24 hours a day, 365 days a year.

- For the convenience of our clients in their face-to-face transactions, in Honduras we have two exclusive service agencies, located in Tegucigalpa and San Pedro Sula. Also, Guatemala, Nicaragua and Panama have one, respectively.

Mortgage Banking

We provide the best housing financing options and facilitate access to decent housing for the population in the region.

- We o er plans that fit di erent payment possibilities to obtain a real estate property, with preferential interest rates according to the payment currency of our customers.

- We specialize in providing personalized advice for the purchase of housing.

Ficohsa Express

It is our care unit dedicated to providing services to the Hispanic and mainly Honduran communities living in the United States.

- We facilitate the sending of remittances throughout Latin America and the payment of basic services in Honduras.

- During 2022 we dedicated ourselves to consolidating the growth of our digital platform with our FicoSend product.

- Part of our future goals is to expand our digital coverage in the USA, reaching all states of Latino presence, and expanding our network of physical agencies.

Remittances

We facilitate the sending and collection of remittances, developing a set of associated banking solutions, with the aim of supporting our compatriots abroad and their families in our countries.

- This year we made an alliance for Western Union remittance payments at TENGO points: This alliance allows people who receive remittances through this remittance company to collect them at 39 new points of attention, which facilitates and expedites collection.

- We join the campaign «Caja Ficohsa, a step away from you» to remind all our clients that they can collect their remittances at all these points of care for your ease and convenience.

Mujeres Adelante

Offer of financial services that includes different financial solutions of savings, loans, credit cards, insurance, and coverages. In addition, support services in financial mentoring, marketing, etc. And other benefits, as well as promotions developed exclusively for female clients.

- We create spaces for companies led by women to o er their products and services to our clients and employees, we also sponsor fairs for women entrepreneurs in di erent parts of the country.

- For more details go to the Responsible Banking section of this report.

Brokerage House

We innovate in the domestic market with the negotiation of international bonds offering the client portfolio such instruments, being the first stock exchange to trade foreign securities.

- In 2022 we conducted the negotiation of international bonds. Brokerage House Honduras continued to rank first in the secondary market.

- We opened custody accounts for clients of the brokerage house in Bank of New York Mellon, being the first Honduran brokerage house to provide this service.

- During this year, we increased our customer base by 18%.

Ficohsa Insurance

We are the leading insurance company in Honduras and Guatemala, we provide peace of mind to our insured, taking care of their tangible and nontangible goods through a wide range of products and services.

- During 2022 we were recognized as the #1 brand in the preference of Hondurans, in the category of insurers according to the regional study of Top of Mind conducted by Kantar Mercaplan for the renowned international magazine Estrategia & Negocios.

- We continue to provide digital attention through the Online Insurance platform where the insured can know, review, and track their policies.

Ficohsa Pensions and Severances

From inception to date, we continue to deliver on our brand promise to all a liates: security and transparency in their investment, high profitability, and innovative service.

At the close of 2022, Ficohsa Pensions and Severances has more than 70 thousand a liates, more than 20% market share and achieved a 30% growth of the managed fund.

As part of our innovation strategy, in 2022 we relaunched the Ficohsa Pensions and Severances mobile app where a liates can consult their fund information at any time and from anywhere.

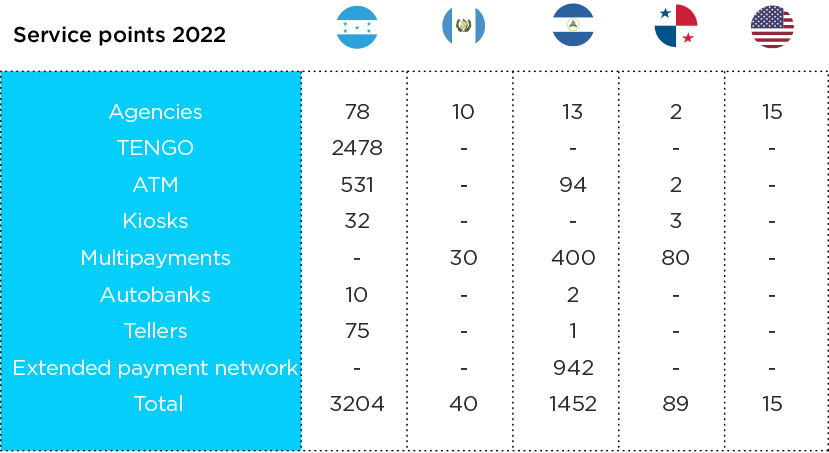

7.1 Our Service Points and Digital Channels

(SASB FN-IN-270a.4, FN-IN-410b.2, FS13)

Institutional Presence

Interbanca, Ficohsa App, and the Agile Automatic Response Service (SARA), are the main non-physical attention points for account management and/or contracting services.

We continue to innovate with digital points, in addition to continuing with the incorporation of new physical agencies; at the regional level we have available our o cial social networks to attend to any questions and queries of our clients.

7.2 Digital Evolution

During 2022 we implemented 20 new improvements in the interbanking platform and mobile app at a regional level, where the incorporation of new technologies in the safekeeping and security of transactions is highlighted, among them the generation of an SMS Token for each transaction ensuring the movements in the accounts. In addition, we completed the consolidation of the regional electronic platform, which allows consolidation of accounts of the 4 countries and making transfers in real-time. As a goal for 2023, we have the implementation of agility models that will allow us to implement features such as Apple Pay, more transactional security features and automatic transaction solution.

In addition, with SARA we implemented 10 new improvements in the platform at the regional level, where the incorporation of new transactions and common language use to facilitate customer communication with the channel. For next year we plan to implement a radical change in the experience of using WhatsApp as well as voice recognition functions.

Through our electronic wallet and the GO application we have established ourselves as the most important and recognized digital multi-payment alternative and multi-banking platform in the country. This year we extended the physical network of correspondent agents nationwide growing +25% in coverage. Additionally, the transactional volume and higher amounts of its history were processed.

During 2022 we realized important alliances, among which we highlight

- Signing an agreement with Banco LAFISE to extend the bank’s services to the different TENGO service channels.

- Collaboration agreement with VISA for the development of programs and products aimed at boosting financial inclusion in the country.

- Enabling the National Traffic Police with services to pay fines and renew licenses throughout the TENGO Points network and in the App.

In 2023, TENGO will launch various payment credentials powered by the collaboration agreement with VISA and develop new digital solutions for the benefit of its thousands of users. For more

information visit:

Digital Factory

For us, digitization is the future of our business. This year we took a firm step in the digital transformation, betting on an in-house factory, for the design of digital financial products and services in Honduras and the region.

During 2022 we invested USD$3.5 M to improve digital attention services.

We invested in the development of universal digital banking solutions, which respond to changing customer needs, with a focus on new and attractive markets.

By 2023 we are working hard to launch two products: opening savings accounts and loan applications 100% digital.

7.3 Information Security

(GRI 3-3, FN-CB-230a.1, FN-CB-230a.2, FN-CF-230a.1, FN-CF-230a.3)

We focus on implementing new controls and strengthening existing ones, to strengthen security and increase the trust of our customers in the products and services provided. In compliance with this goal, our information security policies have been updated and adapted to new working strategies.

Due to new business strategies and reported attack trends in recent years globally, the security of digital channels was strengthened by applying fraud prevention controls to increase the confidence of our customers in the operations performed on FFG transactional sites. Also, external and internal awareness was expanded to proactively identify phishing attacks and, avoid being victims of this threat so popular in the era of digital transformation.

We work hand in hand with our suppliers to maintain the standards, focusing on the guidelines established in the Information Security Policies, which are applied to all who are related by services that require the treatment, transmission, or storage of information. Providers must go through the third-party review process in which security controls are evaluated and remediation plans are established.

Information protection clauses are included in all contracts signed, with the aim of ensuring compliance, confidentiality, integrity, and availability.

FFG is working under the best practices of Cybersecurity NIST SP800-53 (National Institute of Standards and Technology).

FFG is working under the best practices of Cybersecurity NIST SP800-53 (National Institute of Standards and Technology) through the cybersecurity assurance project, complying with the controls established according to the maturity levels of the ICMM scale (Integrated Capability Maturity Model), as best practices towards the issues of Security and Cyber Resilience to achieve the minimum possible impact to keep operations protected and in normal functioning.

New controls were also introduced to identify and contain potential threats in the internal data network, expanding vulnerability identification coverage and timely monitoring of equipment to identify configuration strengthening needs, to mitigate potential risks. All emails received internally are filtered by specialized cloud services to avoid becoming victims of phishing infection.

We maintained internal and external campaigns throughout the year as well as webinars for clients and employees on issues of information security, cybersecurity, and how to prevent digital fraud for the financial user.

At the summary level, an average of 47,000 awareness emails were sent to employees and 528,000 to clients.

7.4 Transparency and Client Satisfaction

(GRI 3-3, 416-1, 416-2, 417-1, 417-2, 417-3, FN-CF-270a.1, FN-CF-270a.3, FN-CF-270a.4, FN-CF-270a.5, FN-IN-270a.1, FN-IN-270a.3, FN-IN-270a.4, FN-MF-270b.3, FN-IB-550b.1)

FFG continues to evolve and strengthen internal regulation, as well as mitigation, control, and monitoring frameworks in the area of client protection, also considering the priorities of the regulator and supervisor. For this reason, we incorporated the vision of protection from the creation and design of new products, as well as existing ones.

Understanding that each word adds to the perception of users, the communication strategy is based on the following principles:

• Transparency of the information provided.

• Clarity in language, structure, and design.

• Responsibility for the interests of the client at all stages of his financial life.

• Establish communication standards to achieve uniformity and consistency in tones, styles, words, and phrase uses across all FFG platforms.

With this same relevance, it is vital to act under our values and ethical guidelines and consequently, o er transparent and fair services. All our clients are informed of the terms and conditions of the products we o er; during this year none of our employees were involved in legal processes initiated by clients.

Also, we have an online tariff where the specifications of the products are detailed:

We encourage good sales practices, making our products inclusive and accessible through empathetic communications, focused on people’s needs.

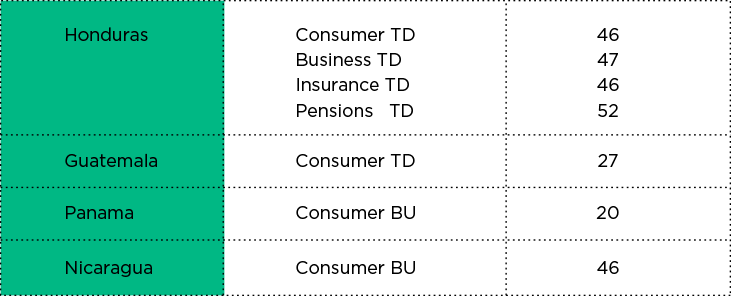

To ensure the experience of our clients, we are constantly looking for feedback and monitoring the level of service we offer using the Net Promoter Score NPS tool with Top Down and Bottom Up methodology to validate the alignment between customer needs and expectations and the initiatives implemented, this allows us to establish plans that eliminate the detected gaps to provide the best experiences.

Annually and every three months, we apply the methodology in our di erent business lines/country to know the net recommendation index that customers give us. Thus, we make sure to identify the possible areas of improvement that are presented to us.

Scores

For Honduras in consumption, business banking, insurance, pensions and in Guatemala we measure the NPS Top Down, and for Nicaragua and Panama we carry out Bottom Up study.

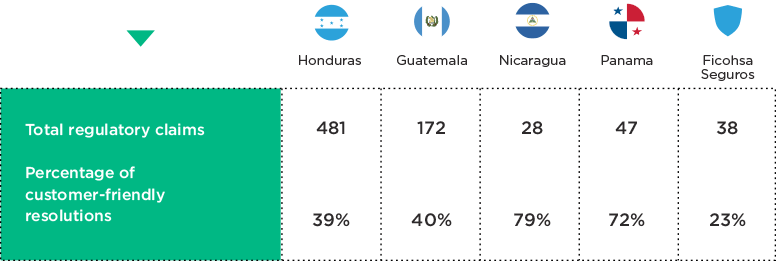

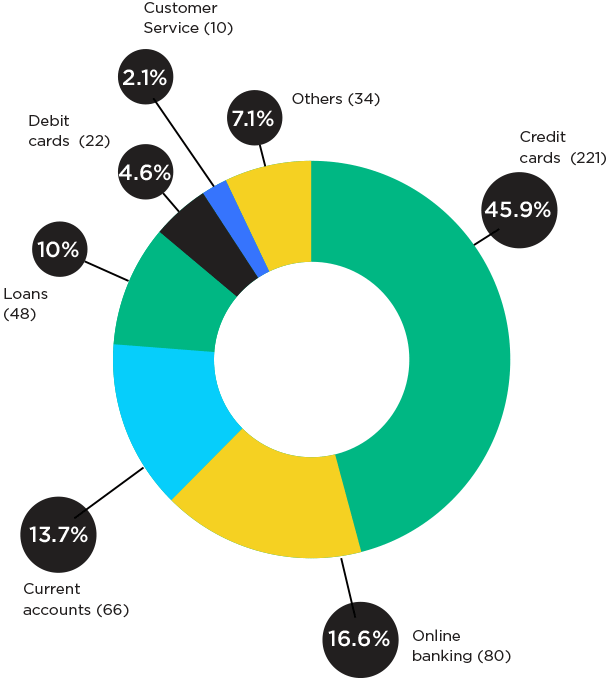

Details of complaints by products

(GRI 418-1)

We remained attentive to the main complaints and observations that took place during the period of this report, always with the orientation of achieving just resolutions in each of the cases.

For us, the best way to provide a quality service to our clients is by listening to their recommendations, opinions, and proposals, so therefore we analyze and manage them to give a favorable resolution.

Of the 481 financial user claims received during 2022 in Honduras, 39% were resolved in a customer-friendly manner, with an average response of 9 business days. An extension was requested for 33% (159) of the claims received. The average number of claims received during 2022 was 40 claims per month.

A customer-friendly resolution can be given by exception issues, application of regulations, policies, operational regulations, etc. However, they are not specifically recorded as operating losses.