Entrepreneur Banking

(SASB FN-CB-240a.1)

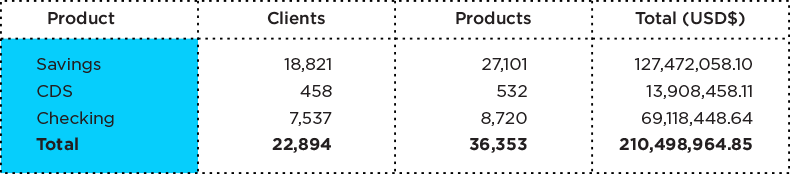

We present the dimensions of our product portfolio by type of customer within the entrepreneurial segment in Honduras at the close of 2022:

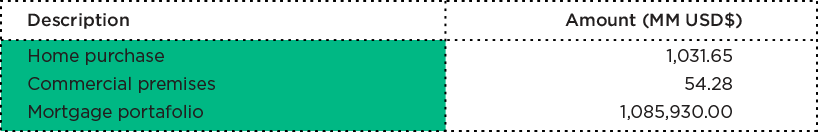

Mortgage Banking

(SASB FN-MF-000.A, FN-MF-270b.1)

We continue to consolidate our leadership in housing financing in Honduras, closing the year with a portfolio balance of USD$450MM which represents a 10.8% growth compared to 2022.

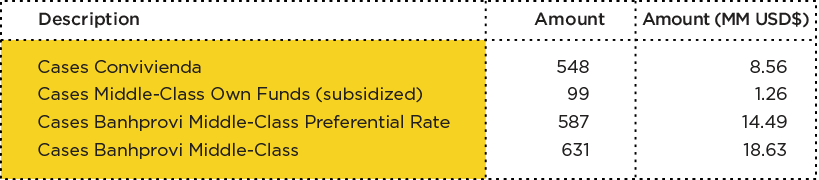

As part of our commitment to the development of Honduras, we continue our support for financing social housing through CONVIVIENDA and the Middle Class Housing program:

Representation Office in United States of America

With a portfolio of USD$25.5MM at the end of the year, USA accounts remain the product par excellence for the e ective development of the banking strategy through remittances and financial inclusion for a market segment composed of Hondurans living abroad.

In addition, the Representation O ce continued with an accelerated step in the placement of housing finance for the purchase and development of properties in Honduras. With a record USD $3.55 MM, USA housing management achieved the highest results of the last 5 years and reached the year-end mark of USD $16.26MM. The product of Vivienda USA is not only a sustainable and profitable service for the operation but is a contributory element to the development of Honduras by generating direct jobs in the construction industry, as well as indirect jobs and added value throughout the business chain.

During 2022, the Representation O ce contributed USD$924.35 MM of net margin to the results of Banco Ficohsa Honduras, thus contributing to the strengthening of the institutional patrimony of Ficohsa Bank Honduras and Ficohsa Financial Group.

Ficohsa Insurance

(SASB FN-IN-000.A)

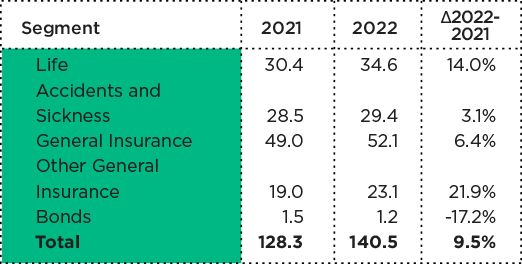

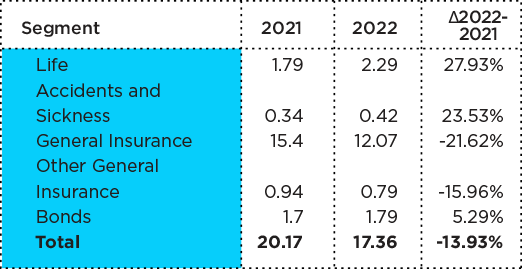

Premiums Issued

For both Honduras and Guatemala, we had an increase in premiums issued during the year. Having the highest premium increase in the bond segment for both countries.

Premiums Issued Honduras (MM USD$)

Premiums Issued-Guatemala (MM USD$)

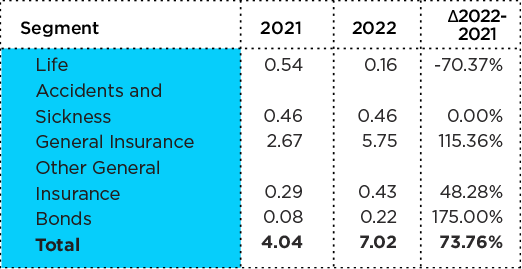

Claims

Honduras (MM USD$)

Guatemala (MM USD$)

Breakdown of Investments

Our insurance subsidiaries invest under a prudent strategy according to the fiduciary duty we have with the insured.

Investment Portfolio Honduras

Investment Portfolio Guatemala

Ficohsa Brokerage House

(SASB FN-IB-000.A, FN-IB-000.B)

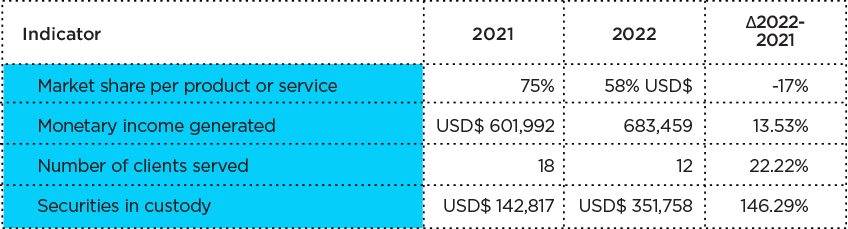

From Ficohsa Brokerage House we contribute to the roup’s performance under the following operating and economic results:

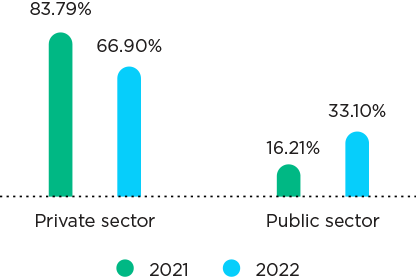

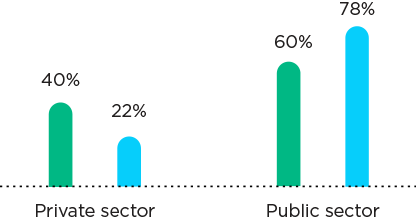

99.59% of investments in Brokerage House come from the public sector. During 2022 we grew 22.22% in our client portfolio.

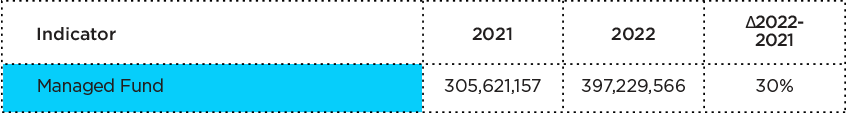

Ficohsa Pensions and Severances

(SASB FN-AC-000.B)

With more than 7 years in the Honduran market, we have performed with excellence, positioned as a leading brand in these services. Growth is associated with the evolution of the small contributor and the progressive results of education in culture of social prevention.

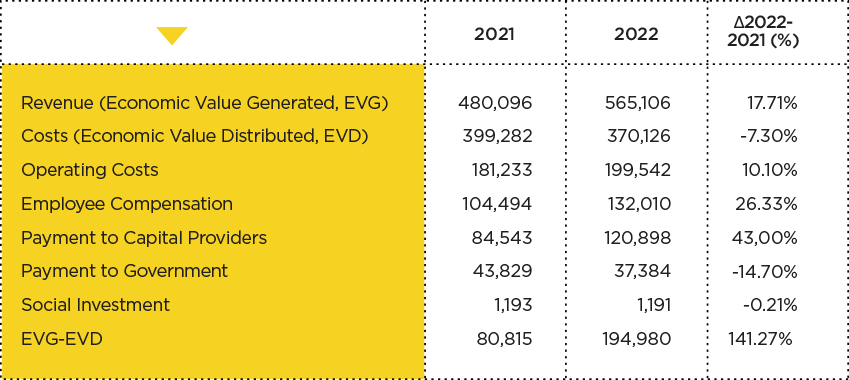

11.3 Economic Value Generated and Distributed

Below we present the distribution of our income in di erent items that are distributed impacting our stakeholders: suppliers, employees, suppliers of capital, government and community.

Economic Value Generated and Distributed (In thousands of USD$)