1 Profile and

Context

1.1 Company Profile

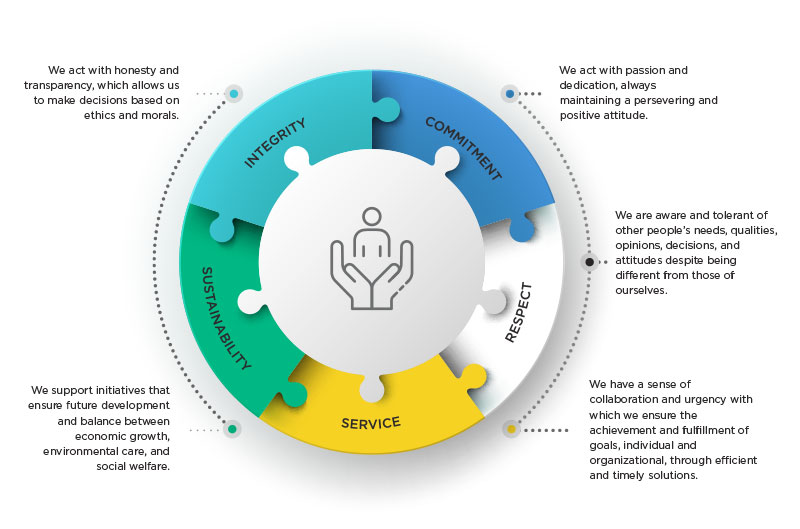

Purpose and Values

We are a regional financial group with 28 years in the financial market that provides quality products and services, with a permanent commitment to people, that materializes in the purpose of «Facilitate solutions that transform lives». We promote sustainable development through inclusive, responsible, transparent economic growth and management aligned with the criteria of Environment, Society, and Governance (ESG).

The Group’s performance is based on principles and values, always betting on ethical, integral, and excellent management that supports our organizational culture, which provides confidence to our customers and other stakeholders.

Mission

Provide the most innovative financial products and services with high-quality standards and the best technology, provided by a qualified human resource; generating security and satisfaction in those who have given us their trust, always committed to being a socially responsible company.

Vision

Ficohsa will be recognized as a solid and reliable group committed to the development of the countries where we are present, where our clients will find effective, agile, and innovative financial solutions.

Ficohsa Values

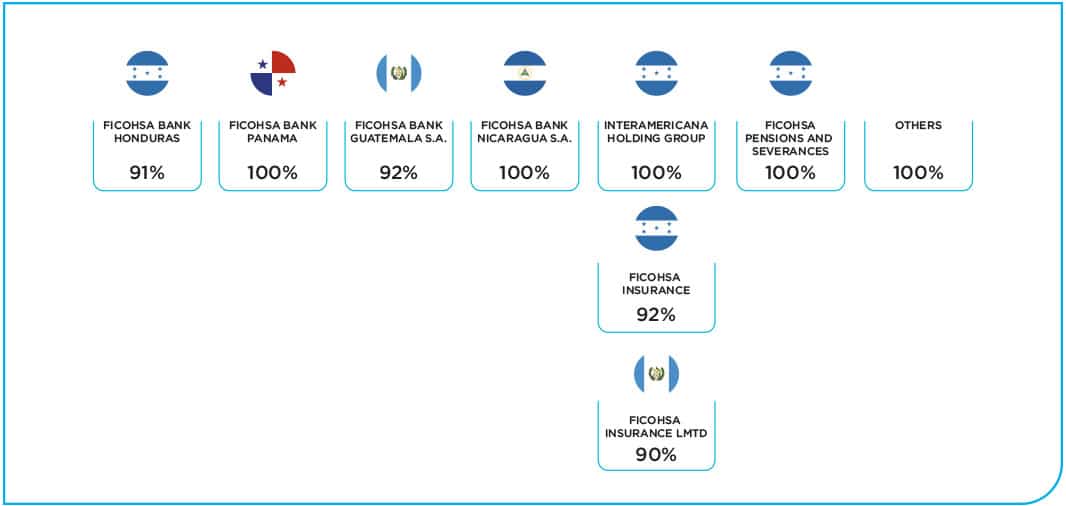

Corporate Structure

FICOHSA FINANCIAL GROUP is a limited company with 100% Honduran capital. The registered office is in Panama City (Panama) and the Holding Company is in Tegucigalpa (Honduras). We have operations in both countries, as well as in Guatemala, Nicaragua, and the United States. We operate under an organizational structure led by Corporate Governance that promotes the efficiency and specialization of teams by service and country.

1.2 Context of the Sector

Contexto Económico de la Región

During 2022 the world economy faced major challenges, one of which was a generalized slowdown and more pronounced than expected, with the highest inflation recorded in several decades. The Russian invasion of Ukraine and the persistence of the COVID-19 pandemic had a significant impact on prospects. World growth is forecast to decelerate from 6.0% in 2021 to 3.2% in 2022 and 2.7% in 2023.

According to the Economic Commission for Latin America and the Caribbean (ECLAC), it estimated that in 2022 the economies of Central America and the Dominican Republic (CADR) had a weighted growth of 4.5%, slightly lower than the 4.9% projected at the beginning of the year. According to these estimates, Honduras grew 3.5%, Guatemala 3.7%, Nicaragua 3.5%, and Panama 7.4% respectively.

Progress in Sustainable Development

According to the report presented by the United Nations at the close of 2022, with the pandemic of COVID-19 in its third year and the war in Ukraine increased the food, energy, humanitarian, and refugee crisis, all this in the context of a climate emergency. This undoubtedly becomes a threat to the fulfillment of the 2030 Agenda for Sustainable Development.

The health and safety crises have led to a setback in the progress of the SDGs. Performance on SDG 1 (End poverty) and SDG 8 (Decent work and economic growth) remains below pre-pandemic levels in many low-income countries (SCIs) and low-middle-income countries (LMICs).

In June 2022, the Network of Solutions for Sustainable Development in partnership with the University of Cambridge published the Sustainable Development Report 2021, a document that year after year through an index of positions, publicizes the most significant advances that the regions and countries of the world have made to the Sustainable Development Goals (SDGs).

Despite the unfavorable economic and social context that exists at the regional and global level, LatAm maintains progress of sustained contribution, only below the economies of the European countries and members of the OECD (Organization for Economic Cooperation and Development). As for the countries in which Ficohsa Financial Group has operations, Nicaragua is the country with the best ranking, ranking 92 out of 163 and with a compliance score of 67.1. Then the position and score for the other countries:

Panama: Honduras: Guatemala:

105 (64.0) 112 (63.1) 117 (61.0)

Finally, according to Sustainable Development Report 2022, it has identi ed eight investment priorities, areas that need major social transformations to achieve the Sustainable Development Goals (SDGs).

Our Financial Services

Our products and services offer innovative financial solutions of the highest quality, according to the needs of both people and micro, small, medium, and large companies to achieve the loyalty and trust of our clients in the countries where we operate.

Financial

Services

Personal Banking

Private Banking

Mortgage Banking

Corporate and Business

Banking Entrepreneur

Banking Ficohsa Express

Mujeres Adelante

Tengo/Cajas Ficohsa

Trust

Ficohsa

Insurance

Individual Insurance

Auto Insurance

Damage Insurance

Ficohsa Pensions

and Severances

Pension Fund

Business Fund

Guaranteed Loan

Ficohsa

Brokerage

Purchase of

Securities Values

Business Detail

We serve:

• Banking + (= USD$2.5M)

• Customer Remittance

• Client Payroll

• Mass Customer

• Employees of private or public    enterprises

• Remittances

• Savings accounts

• Checking accounts

• Credit and debit cards

• Loans

• Insurance banking

• Digital services (Mobile Banking,    Interbanca, ESRM, FICOTICKET, Ficohsa    App)

• Term deposit certificates

• Deposit certificates

• Insurance

• Credit and debit cards

• Assigned financial adviser

• Checking accounts

• Loans

• Digital services

We serve:

• Natural persons

• Legal entities

• Legal entities

• Institutional clients

• Contingent assets

Business Banking

We serve:

• Large Corporate

• Corporate

• Business

• Institutional

• Institutional clients

• Credit Solutions (Corporate and Business    Credit, Factoring, Financial Leasing, Bank    Guarantees)

• Payment Solutions (Suppliers and/or Third    Parties, Credit Cards, Checks Confirmed,    Services, Taxes)

• Collection Solutions (FicoPOS, Securities    Collection, Corporate Tellers, Collections,    Efective Payroll)

• International Services (Foreign Exchange    Buying and Selling, International Transfers,    Sending SWIFT Statements, Factoring    International/Local, Foreign    Trade)

• Integration Solutions (Host to Host, Swift    to Host)

• Digital Services

• Small and Medium-sized Enterprises    (SMEs))

• Legal entities

• Savings Account Ficohsa Small    Entrepreneur

• Credit Card Entrepreneur

• Credit Lines

• Letters of Credit

• Loans for Fixed Investments, Machinery,    Vehicle Fleets

• Securities Collection

• Payroll Payment/Suppliers

• Tax Payment

• International Transfers

• Buying and Selling of Foreign Exchange

• Collections

• Ficocheque Confirmed

• Programmed Savings

• Ficointegra Software

• Automatic Disbursement under credit Line    through Interbanca

• Medical Assistance    Entrepreneur/Multiassistance Entrepreneur

• Ficomall/Catracha Store

We serve:

• Small and Medium-sized Enterprises    (SMEs)

• Large Businesses

• Independent Professionals

• Executives

• Legal entities

• Consumer loan/ Consolidation of debts

• Ficoauto

• Mortgage loan

• Entrepreneur banking

• Acquisitions services

• Pension fund

• Insurance

• Non-financial services (recognition,    education, access    to information, and    networking spaces)

We serve:

• Natural clients

• Micro, Small and Medium-sized    Enterprises (MSMEs)

• Large Businesses

• Legal entities

• Institutional clients

• Medical Expenses Insurance

• Life Insurance

• Individual Insurance

• Personal Accident Insurance (individual or    collective)

AUTO INSURANCE

• Individual

• Collective

• Civil Liability

• Bicycle Insurance

DAMAGE INSURANCE

• All fire and/or lightning risk Civil Liability

• Maritime Hull

• Aviation

• Pet Insurance

We serve:

• Large Businesses

• Legal Clients

• Institutional Clients

• Subscription of Emissions

• Design, structuring and Registration of    Emissions

and Severances

We serve:

• Natural clients

• Legal Clients

• Legal entities

• Institutional Clients

• Business Pension Fund

• Integral Protection Plan

• Business Layoff

• Loans with Guarantee

• Credit Card Futura