2Corporate

Governance

(GRI 2-8, 2-9, 2-10, 2-11, 2-12, 2-13, 2-15, 2-17, 2-18, 3-3)

We are aware that the basis to promote sustainable economic development to achieve the well-being of all is corporate governance with a vision to generate a positive impact with the operation, working hand in hand with our stakeholders in relation to their expectations and needs, as a focal point for our business. And also, promoting the well-being and health of employees and a good client experience, driving the growth of our value chain and positively impacting the communities where we have a presence.

Competencias y guías de actuación del Gobierno Corporativo

- Long-term development and growth on firm sustainable foundations.

- Respect for the requirements imposed on the legal framework.

- Fulfillment of commitments to different stakeholders.

- Observance of ethical duties..

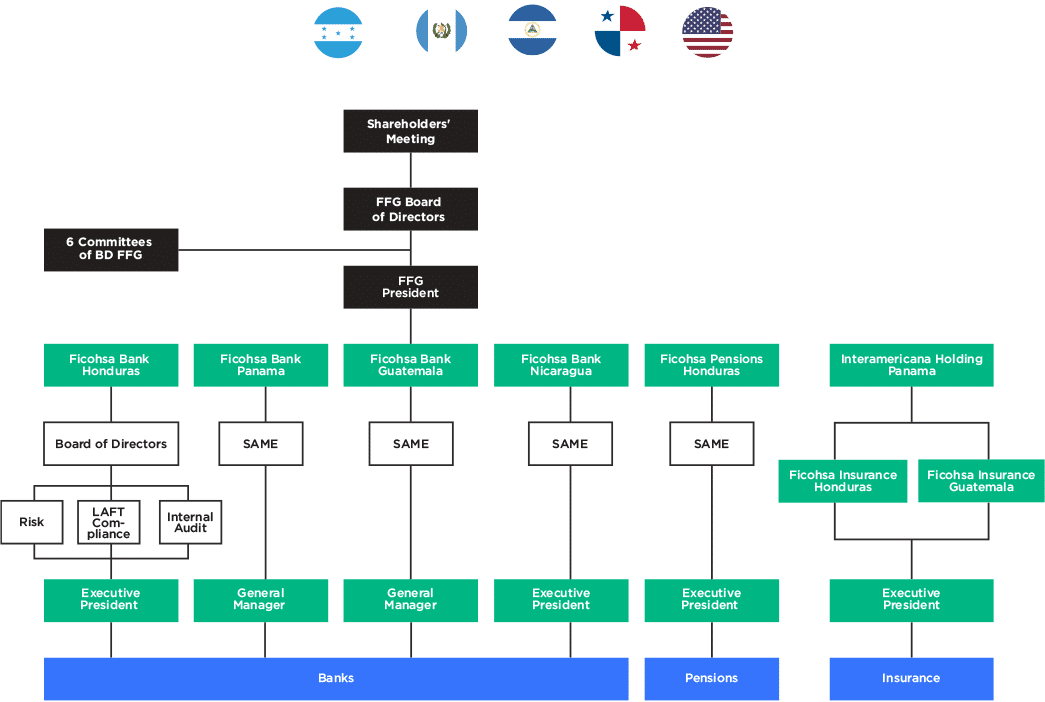

Corporate Governance Structure in FFG

The Shareholders’ General Assembly is the supreme and sovereign body of FFG and brings together the holders of our securities in a collegiate manner, articulating their right to intervene in decision-making. It is responsible for approving the financial statements, the destination of profits and the payment of dividends. Appoints the external auditor and approves or ratifies certain strategic or extraordinary operations.

The sessions of the Assemblies may be ordinary or extraordinary. In the case of ordinary cases, the first must be convened within 120 calendar days after the close of the fiscal year.

The Shareholders’ General Assembly meets at least once a year in an ordinary manner, with the possibility of extraordinary sessions as determined by the Board of Directors. They are developed as determined by the Social Pact in compliance with the applicable law.

In 2022 we had 100% attendance of the members of the Assembly in the ordinary sessions held.

On the Board of Directors

Followed by the Shareholders’ Meeting, the Board of Directors is the highest body responsible for the management of the Group. Its functions include establishing the corporate strategy and authorizing the annual budget, as well as approving and enforcing internal policies and procedures, including the operation of internal control systems.

The President ensures that the Board of Directors e ciently sets and implements the strategic direction and drives FFG’s governance action, including acting as a liaison between shareholders and the Board. He chairs not only the Board of Directors but also the Shareholders’ General Assembly and directs the debates and represents FFG among other functions.

The Secretary of the Board of Directors assists the President in the preparation of the agenda of the meetings, as well as coordinates the preparation and distribution among the Directors of documentation associated with the agenda items, also prepares the Minutes of the meetings of the General Meeting of Shareholders, Board of Directors of FFG and its Committees among other assigned functions.

We have Boards of Directors for each subsidiary according to the regulations of each country.

On the appointment and evaluation of the Board members

For their appointment, both the Shareholders’ Assemblies and Boards of Directors have the power to propose to their candidates, supported by the Corporate Governance Committee charged with evaluating, according to the needs of the business, the competencies and knowledge of these.

Directors should therefore have a professional profile with extensive experience in positions in the banking industry and knowledge of the trends to which the sector is headed.

Their participation may be for periods of 2-3 years with the option of re-election without limitations.

Internal or Executive

Directors:

Those professionally linked and remunerated by the companies of the Group; may be shareholders.

External Assets

Directors:

Shareowners and not working in the Group´s companies.

External Independent

Directors:

Those whose relation to Ficohsa Financial Group is solely and exclusively as a member of the Board of Directors.

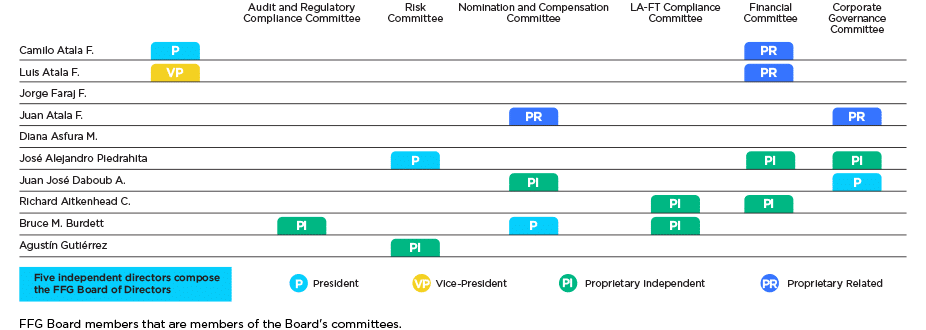

The remuneration of the Board of Directors and its committees is the responsibility of the General Shareholders’ Meeting, which consists of monthly set attendance fees. We present the composition of the Board of Directors of FFG and the Support Committees, reelected in the Ordinary Assembly of 2022; the average seniority of its members in the function of Directors is 10 years.

Points of reference according to represented position

Of the Functions of the Committee

The Board is supported by a series of Steering Committees, with support, study, and proposal functions. It is the Board itself that establishes the members of the committees according to their professional training, integrity, competencies, and experience. They are represented by Directors with experience according to the functions and objectives of each of these instances.

Ficohsa Financial Group Board Committees

Nico Klaas Gerardus Pijl

Bruce Malcolm Burdett

Member

Member

Javier Eduardo Atala Faraj

Agustín Gutierrez

Member

Member

José Leonel Giannini Kafie

Juan Carlos Atala Faraj

Juan José Daboub Abdala

Member

Member

Member

Nico Klaas Gerardus Pijl

Bruce Malcolm Burdett

Member

Member

Luis Alberto Atala Faraj

Javier Eduardo Atala Faraj

Richard Aitkenhead Castillo

José Alejandro Piedrahita Tello

Humberto Sangiovanni

José Arturo Alvarado Cortés

Colin Dore Veater Walter

Member

Member

Member

Member

Member

Guest

Corporate Secretary

Juan Carlos Atala Faraj

José Alejandro Piedrahita Tello

Member

Member

The structure of Committees of the Board of Directors of FFG is organized in a staggered manner in the following two levels or components:

1. Committees of the Board of Directors of Ficohsa Financial Group, S.A.

2. Country Committees for Audit, Risk and LA-FT areas.

Under this scheme, the structure of Board of Directors Committees always originates in the Board of Directors of the parent, Ficohsa Financial Group, S.A. and for some specific areas, such as Audit, Risks, and LA-FT, descends at the country level.