Double Materiality Analysis

(Impact and Financial)

GRI 3-1, 3-2

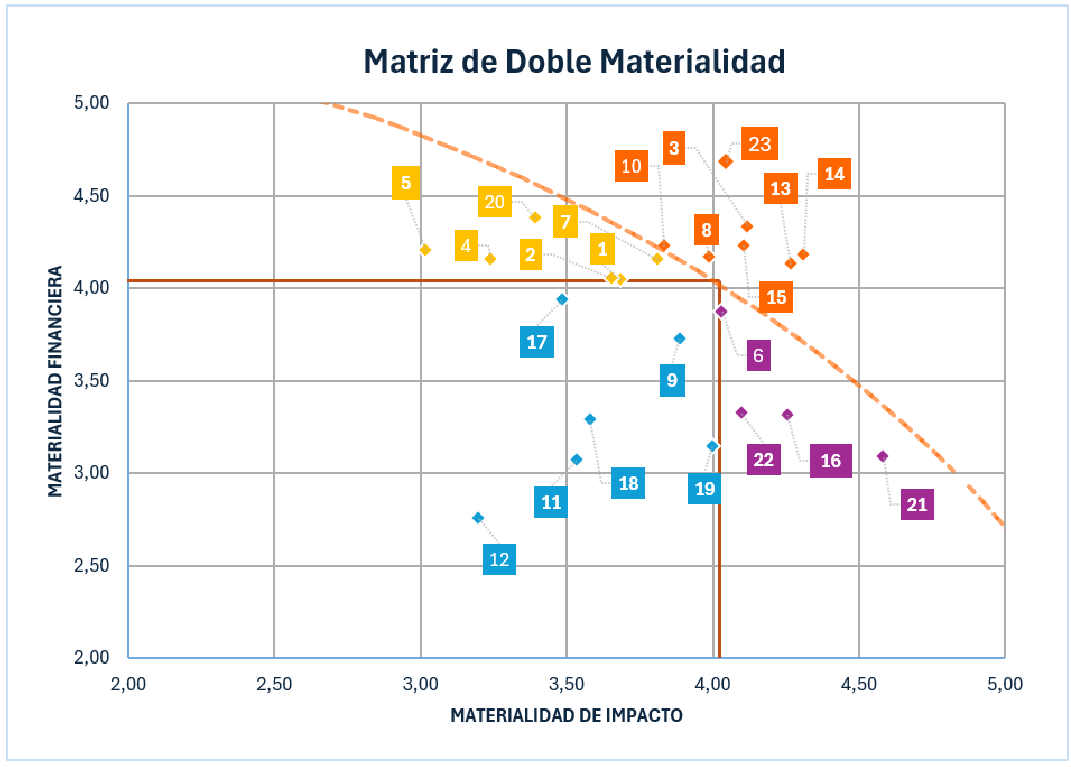

In order to identify priority sustainability issues for Ficohsa, an update of the materiality analysis was carried out in 2025,

adopting the double materiality approach.

The first step consisted of conducting a global analysis of environmental, social, and governance (ESG) trends, using peer companies and international industry standards as references, such as the Global Reporting Initiative (GRI) Standards, the Sustainability Accounting Standards Board (SASB) sector standards, and the Morgan Stanley Capital International (MSCI) sector materiality map, among others. This exercise allowed for the development of a preliminary list of relevant issues, aligned with current sustainability expectations for the financial sector.

For each issue identified in this list, a detailed analysis of environmental risks and opportunities with a potential impact on the business was conducted. Likewise, the impacts generated by the Ficohsa Group and its business lines on their surroundings were assessed, considering all its stakeholders, including nature.

The assessment of material impact topics was developed based on the most recent recommendations of the 2021 GRI Standards and the OECD methodology for assessing human rights impacts, incorporating criteria such as scale, scope, likelihood, and remediation. For the financial materiality analysis, the guidelines of International Financial Reporting Standards (IFRS) S1, published in 2023, and the Committee of Sponsoring Organizations of the Treadway Commission (COSO).

As a result of this process, prioritization matrices were developed that allow for visualization of both material and financially material impacts, identifying the most relevant impacts, risks, and opportunities for the business. Finally, a Dual Materiality Matrix was consolidated, presenting the priority topics for Ficohsa’s sustainability strategy.