5.2 Relevant Data by

country

(FS6) (SASB FN-CB-000.A, FN-CB-410a.1)

Credit Breakdown delivered by Sector

*Otros: Avicultura, pesca, ganadería, transporte, comunicaciones, financiamientos de exportación e instituciones descentralizadas.

Credit Breakdown

delivered by Sector

*Otros: Transporte y logística, comercio, manufactura, construcción, administración pública y defensa, actividades financieras y de seguros, actividades de servicio administrativo y de apoyo, actividades inmobiliarias, agricultura, ganadería, silvicultura, pesca, actividades de atención de la salud humana y de asistencia social y otras actividades de servicio.

Breakdown of Credit

Provided by Sector

*Otros: Avicultura, pesca, ganadería, transporte, comunicaciones, financiamientos de exportación e instituciones descentralizadas.

Entrepreneur Banking

(SASB FN-CB-240a.1)

The dimensions of the product portfolio by type of client within the entrepreneurial segment in Honduras at the end of 2024 are presented:

Mortgage Banking

(SASB FN-MF-000.A, FN-MF-270b.1)

Specializing in providing high-quality housing financing options designed to guarantee access to decent housing. Our goal is to make it easier for the region’s population to acquire a suitable home, providing affordable options tailored to their financial needs. Through comprehensive benefits, we seek to boost housing development and improve families’ quality of life.

Offering additional benefits and services, including: competitive interest rates, terms up to 30 years, life and property damage insurance, bank-paid appraisal, rapid resolution, and personalized credit processing advice before, during, and after the process.

Significant achievements during 2024:

Representative Office in the United

States of America

With over 10% growth in its account portfolio for receiving remittances sent from the US, the Ficohsa Bank Representative Office consolidated its banking and financial inclusion strategy during 2024. The balance of deposits in personal savings accounts held by Honduran citizens residing in the US reached USD $28.66 million, distributed across over 7,000 account holders.

The ease and security of the onboarding processes for customers, from the initial contact to opening the account to the final step of activating their debit card, strengthens the trust Hondurans have in Banco Ficohsa’s savings products in the US.

The results confirmed the alignment of the benefits of the US account with the financial needs of customers abroad.

The home financing product for the purchase and development of properties in Honduras also achieved record production figures, with USD $5.29 million invested in mortgage financing. Additionally, the significant and symbolic mark of USD $20 MM in active portfolio was surpassed.

It is important to emphasize the value of the US housing product, not only as a sustainable and profitable service for Ficohsa Bank operations in the US, but also as a contributor to the sustainable development of Honduras.

In terms of net income, the contribution margin also showed a positive growth trend for the 2024 period. With a net income of USD $1.49 million as a result of its management, the Representative Office confirms its mission to be a cross-border contributor to the results of Ficohsa Bank Honduras, strengthening its institutional assets, as well as those of Ficohsa Group at the regional level.

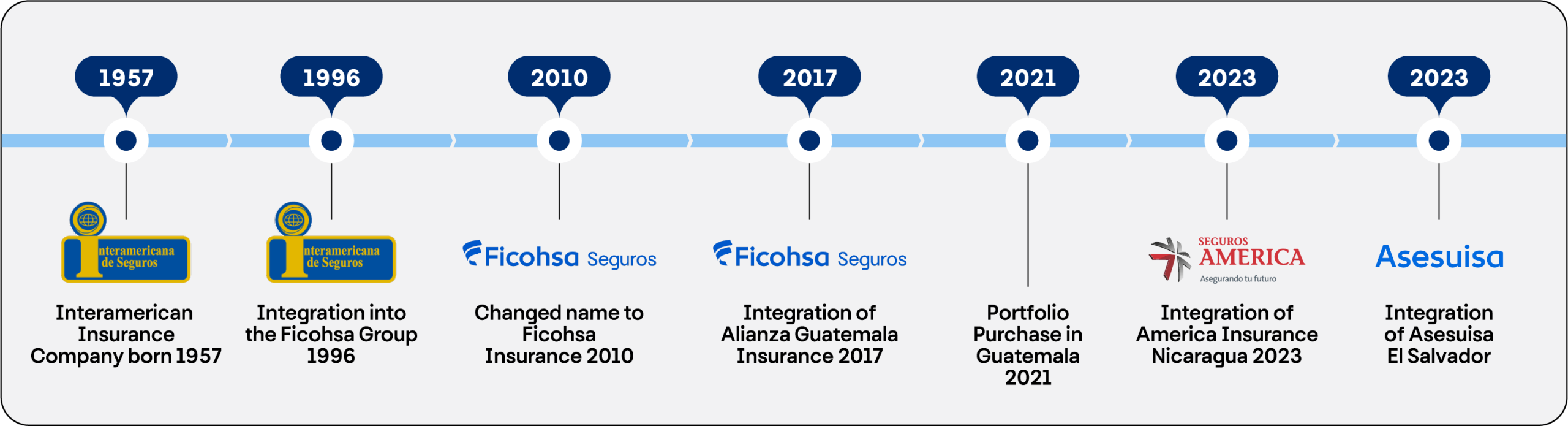

Ficohsa Insurance

(SASB FN-IN-000.A, FN-IN-410a.1)

For 68 years, we’ve been making history and innovating in the region. Today, we’re the fastest-growing insurance group, thanks to our experience, financial strength, and commitment to the families and businesses that are part of this great company.

Ficohsa Insurance continues to implement the Quality Management ISO 9001/2015 certification.

Premiums issued

Claims

Investment breakdown

Insurance subsidiaries invest under a prudent strategy in accordance with the fiduciary duty owed to insurers.

Asesuisa’s investment portfolio includes a USD $3,000,000.00 bond to support sustainability projects in line with sustainable investment.

Ficohsa Brokerage House

(SASB FN-IB-000.A, FN-IB-000.B)

From the Ficohsa Stock Exchange, we contribute to the group’s performance through the following operating and economic.

Ficohsa Brokerage House remains at the forefront, leading both on- and off-exchange trading in the national secondary market for the fifth consecutive year, transacting a total of $242.22 million in 2024.

In 2024, it was the first brokerage firm to negotiate a new instrument called a Structured Note, issued by Morgan Stanley. It also played a key role in brokering the first Bilingual Stock Market Repurchase Agreement (BRS) between two of its main clients, through the Central American Stock Exchange.

Ficohsa Pensions and Severances

With nearly 10 years of experience in the Honduran market, Ficohsa Pensiones y Cesantías excels in managing more than $400 million in assets, offering innovative services through various digital channels: website, app, SARA, and Interbanca, in addition to tools for members to self-serve.